tax exemption malaysia 2018

1 There is also a revised treatment of real property gain tax which would affect non-citizens and non-permanent residents. Malaysias prime minister presented the 2018 Budget proposals on 27 October 2017 and announced a slight reduction in individual income tax rates and partial exemption of rental income.

Malaysia Service Tax 2018.

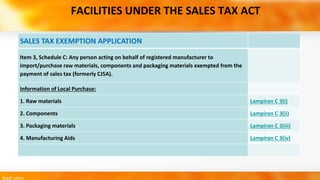

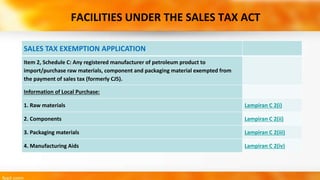

. The tax exemption is available for a maximum period of three consecutive years of assessment from 2018 to 2020. Subsection 81 STA 2018 4 The Minister may by order and subject to conditions as he deems fit exempt any person or class of person from payment of the whole or any part of the sales tax which may be charged and levied on any taxable goods manufactured or imported Power Of Minister To Exempt Section 351b STA 2018 5. The individual who is.

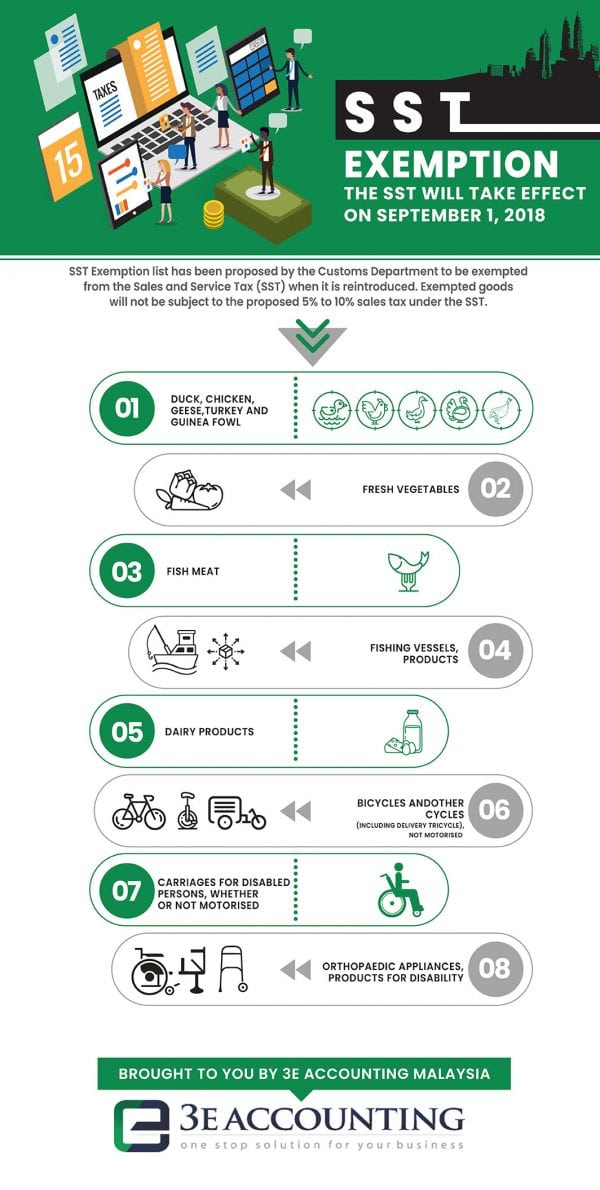

The Real Property Gains Tax Exemption Order 2018 which was gazetted today exempts an individual from payment of real property gains tax on the chargeable gain accruing on the disposal of a chargeable asset excluding shares in a real property company subject to the following conditions being fulfilled. 28 December 2018. Following the announcement of the re-introduction of SST the Royal Malaysian Customs Department RMCD has recently announced the implementation framework of SST as well as a detailed FAQs to arm Malaysians with sufficient knowledge before SST commence.

This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. D rents royalties or premium. 2 Medical and dental benefit.

The above mentioned exemption is applicable for sale and purchase agreement executed from 1st January 2017 to 31 December 2018. Vacation time paid for by your employer in two categories. Between RM300001 and RM500000.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018.

A gains or profits from a business. A 3882018 General This Exemption Order was gazetted on 31 December 2018 refer to our e-CTIM TECH-DT 32019 dated 9 January 2019. 100 on the first RM300000 and excess is subject to the prevailing rate of stamp duty.

B gains or profits from an employment. As highlighted in earlier tax alerts the financial incentives under the Multimedia Super Corridor MSC Malaysia Bill of Guarantee No. Thats a difference of RM1055 in taxes.

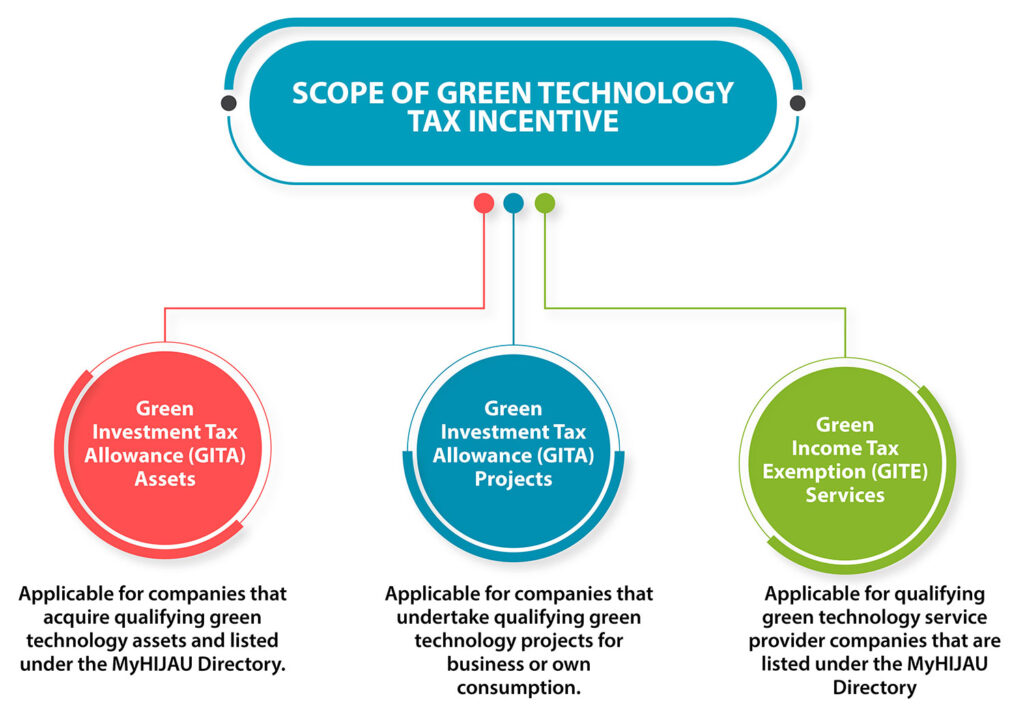

5 BOG have been reviewed and amended to adhere to the minimum standards under Action 5 of the Organization for Economic Cooperation and Development OECDs Base Erosion and Profit Shifting BEPS Project see Tax Alert No. It provides exemption from income tax on statutory income of a company carrying on a qualifying activity in relation to green technology and meets with all the requirements set out in this Order. E pensions annuities or other periodical payments not falling under any of the.

The PS incentive involves a tax exemption for 70 of statutory income 100 for certain activities for a period of five years which can be extended to a tax holiday of up to 10 years. These new rates will apply for those who have accumulated their income from January 2018 to December 2018 and are filing their taxes from March April 2019. The actual Budget announcement itself does state that the Government hopes to encourage Malaysian resident individuals.

The Real Property Gains Tax Exemption Order 2018 PUA 360 gazetted on 28 December 2018 provides that a Malaysian citizen individual is exempted from real property gains tax RPGT on the chargeable gain derived from the disposal of a chargeable asset other than shares from 1 January 2019 see Tax Alert No. B deduction of tax from special classes of income. A resident company incorporated in Malaysia with an ordinary paid-up share capital of RM25 million and belowor 2.

The following income categories are exempt from income tax. Objective The objective of this Public Ruling PR is to explain the - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA. Exemption given on stamp duty.

The actual Budget announcement itself does state that the Government hopes to encourage Malaysian resident individuals to rent out residential homes at reasonable charges. 20182019 Malaysian Tax Booklet 8 Classes of income Income tax is chargeable on the following classes of income. For the 2020 year of assessment property owners who offer at least 30 rental discounts to small and medium enterprise tenants from April 2020 to September 2020 are entitled to a special deduction for the rental reduction.

This Order will apply only if. Tax exemption is given for a maximum period of 3 consecutive years of assessment from 2018 to 2020. Tax exemption is given for a maximum period of 3 consecutive years of assessment from 2018 to 2020.

5 December 2018 Page 1 of 39 1. C dividends interest or discounts. The PS incentive is available to companies undertaking a promoted activity or producing a promoted product.

The service tax will stand at 6 and it would be levied on. SME It is proposed that the income tax rate on first RM500000 of chargeable income of SME be reduced from 18 to 17. You are entitled to tax exemption not exceeding three times in a year for leave passage within Malaysia and one leave passage outside Malaysia not exceeding RM3000.

Green Investment Tax Allowance Gita Green Income Tax Exemption Gite Malaysian Green Technology And Climate Change Corporation

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Taxation In Bangladesh Incentives Transfer Pricing Dtas Repatriation

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Income Tax Malaysia 2018 Mypf My

Sales And Service Tax Act 2018

Sales And Service Tax Act 2018

Pemerkasa Assistance Package Crowe Malaysia Plt

Malaysia Personal Income Tax Guide 2021 Ya 2020

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Goods And Person Exempted From Sales Tax Sst Malaysia

Income Tax Slab For Women And Income Tax Benefits For Women

Mazda Prices Revised Based On Sales Tax Exemption In Malaysia Autoworld Com My

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Sales And Service Tax Act 2018

Public Revenue To Shrink To Rm227 3b In 2020 Amid Lower Tax Collection The Edge Markets

Updated Guide On Donations And Gifts Tax Deductions

0 Response to "tax exemption malaysia 2018"

Post a Comment